Rome Wasn't Built in a Day:

The Inconvenient Truth About Microinsurance

An increasing number of organisations prove that microinsurance can be both sustainable and profitable. But, as they say, Rome wasn’t built in a day.

The issue

It takes time to build a successful microinsurance business.

Unfortunately, many projects fail because they were promised to deliver large-scale profits within three years, leading to sky-high expectations that are often hard to meet within a short time frame. The management or board becomes disappointed with the lack of results and shuts down the project before it can prove itself.

This is not unique to microinsurance.

Scaling innovation takes time

Microinsurance and innovation share many analogies.

It takes time for any new innovation to break through in the market and become profitable, invariably taking longer than it was anticipated at the beginning.

Or as Bill Gates put it: “Most people overestimate what they can achieve in a year and underestimate what they can achieve in ten years.”

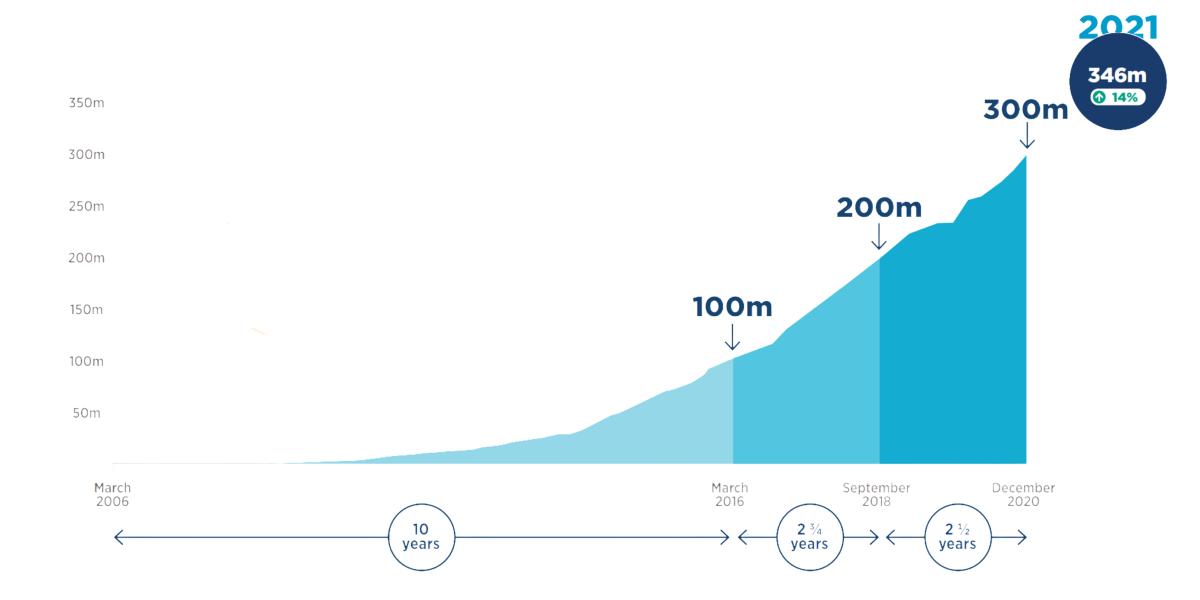

Just look at fast growth of mobile money. As the graph below shows, it took 15 years to scale to a market of about 350 million active user accounts, with 10 years (!) to the 100 million active users milestone. During that time, close to 90 mobile network operators closed their mobile money schemes prematurely.

It is important to note that innovative services or products are seldom an instant hit and do not follow a linear growth path. Growth looks more like a hockey stick.

The “diffusion of innovation” theory explains that before a lot of people start using a new product, it needs approval from a few trustworthy adopters. Without their endorsement, the majority of people will not be interested in giving it a try.

There are many similarities to draw between microinsurance and other innovations. But microinsurance also comes with some unique characteristics and challenges

Insurance has a bad reputation

Low-income communities often have a skeptical and distrusting view of insurance, making it a tough sell.

Let’s face it nobody’s jumping out of bed in the morning saying, “Oh boy, I can’t wait to buy insurance today!”

It’s just not a product that gives you instant gratification as a sweet treat would. You don’t get anything in your hands when you sign up. It is an intangible service, a promise from a big corporate that it will serve you in times of need. Feels a little hollow and untrustworthy, doesn’t it?

Things will only start to change when people or their peers will start to experience claims.

“It actually works! This company actually does live up to its promise!”

That’s the moment of truth on which you can capitalise and grow. But claims don’t happen soon after signing up (and if they do – the insurer might invoke a waiting period clause) adding further delays to the instant hit that was promised in the business plan.

Many moving parts

Microinsurance is mostly distributed through intermediaries. This means you don’t fully own the agenda or the speed of progress. It takes time to find the right distribution partners, agree on a product, develop and implement it, not to mention get the insurance regulator’s approval.

What can you do about it?

1. Exceed customer expectations

Make sure people can experience the benefits of insurance, whether through claims or other services, such as teleconsultations. Design a solution for a risk people really care about, and ensure a high claims frequency and fast payout. Positive experiences will turn the early adopters into ambassadors for your offering and boost take-up by the word of mouth.

2. Set realistic targets

Ask yourself, “What can we achieve within three years?”

Keep in mind that the success of your project is dependent on external factors and actors like intermediaries and the regulator. Think big, but act small. Learning from the results of experiments, the good and in particular the bad, is more important in the early days than focusing on scaling. Once you have figured out your product-market fit it will be easier to scale.

3. Learn from what others have figured out

Rome wasn’t built in a day, but you can skip the trial-and-error process and fast-track your progress by learning from the best in the microinsurance sector.

In the early days, for example, several insurers attempted to launch their offerings nationwide with expensive advertising campaigns. They learned the hard way that low-income customers often struggle to understand the concept of insurance and have little trust in insurers. The B2B2C model, however, has emerged as a viable solution. Through strategic partnerships with trusted organisations, insurers can more effectively and efficiently scale microinsurance, reducing risk and increasing customer satisfaction.

There are many more lessons, big and small, on how to boost your microinsurance activities. We have documented some of the key ones in this article.

In conclusion

Building a profitable microinsurance business is an endurance game, it takes time and effort, but several microinsurers have demonstrated how it can be done:

- Set realistic expectations for what you can achieve in the early days,

- Learn from others, and

- Make sure your beneficiaries experience the benefits of insurance

so that you grow through the word of mouth.

The good news is, there is a time-saving shortcut

“Smart people learn from their mistakes. But the real sharp ones learn from the mistakes of others” – Brandon Mull

The Microinsurance Master accelerator programme can help.

With a 98% recommendation rating from 95 executives in 35 countries, it’s a proven shortcut to success.

The programme is designed to accelerate your microinsurance activities by inspiring and strengthening you with what others have figured out.

The 2024 edition of Microinsurance Master is full booked but we are already accepting application for the 2025 cohort.

The accelerator is limited to 20 microinsurance executives on a first-come, first-served basis. Apply now to join us in making a difference in microinsurance or find out more about the programme here.