How to Thrive in Microinsurance

We are privileged at Microinsurance Master to work with a wide range of microinsurance champions. On one end of the spectrum, we work with leaders who have already built and scaled a thriving microinsurance practice. They are doing well by doing good. We also work with organisations at the start of their microinsurance journey. They want to avoid making the same mistakes as others made and start on the right footing to make a true success of their business.

By working closely with such a variety of players — from local dedicated microinsurers to multinationals and from mutuals to insurtechs — we have learnt from their successes and failures and have been able to distil a list of key ingredients that are essential to the “recipe” of how to thrive in microinsurance.

In this webinar, we discuss these key ingredients, what they mean and how they interact. A summary is included below the video.

Summary

At Microinsurance Master we worked with over 100 organisations in 40 countries since 2017. Together with the leaders of these organsations, we distilled a list of key ingredients that are essential to the “recipe” of how to thrive in microinsurance.

These ingredients shouldn’t be considered as a menu, from which you can select a few that you fancy. Great recipes are created when you apply these ingredients all together. Only then will these recipes be successful in generating customers who recommend your services to their peers, robust partnerships, and a solid compounded growth.

We also need to keep in mind that organisations, partners and markets differ. The key, then, is not to build an exact replica of what worked for one organisation but to tailor, tweak, and flavour the recipe to your specific setting.

Before we get in into the key ingredients, let’s also keep in mind that successful microinsurance recipes significantly differ from those applied in retail insurance. If the retail formula worked for selling insurance to low-income market segments, the market would already be served. Microinsurance requires a radically different go-to-market approach. But it is one that retail insurers can also learn from.

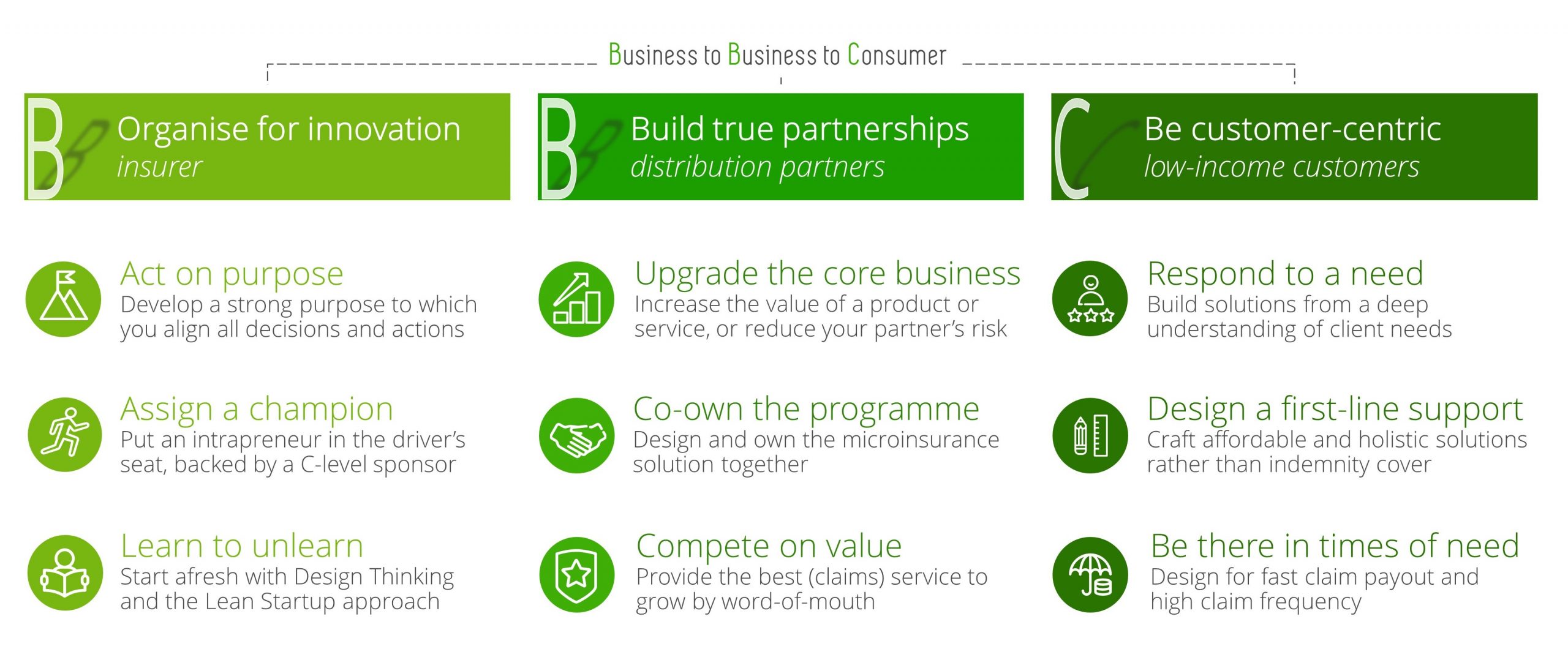

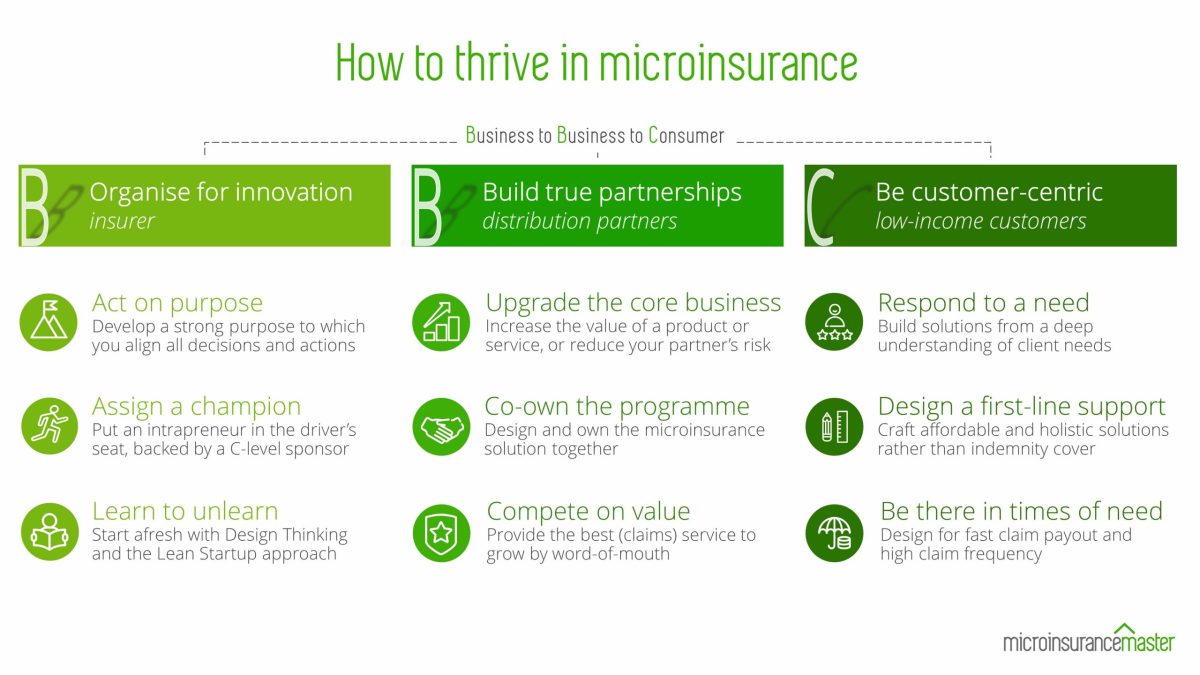

Microinsurance is best approached as B2B2C

Microinsurance businesses thrive best with a customer-centric B2B2C business model. The business to business to consumer model is not the only model that exists, but it has proven to work best for different organisations in different markets and settings.

Mobile and digital communication channels make it tempting for insurers to think they can cut out the middlemen and go directly to consumers. But as the old saying goes, no one wakes up wanting to buy insurance. This applies even more to low-income households with no experience of insurance and scarce financial means. Having an app or a USSD-code won’t change that overnight.

Another challenge is that insurance brands are not as well known, let alone trusted, in low-income market segments. That’s why partnering with organisations that people know, trust and use remains the most effective and efficient way to start and scale microinsurance activities.

These partners have already built trusted relationships with the target market and this forms a great foundation to educate, bundle or sell insurance solutions that make a difference for the partner and their clients, members or beneficiaries.

The key ingredients to thrive in microinsurance

A true customer-centric approach means that we must start from the customer and work our way back to the product and organisation, rather than the other way around. So, we will present the nine key ingredients, starting with the customer-related ones.

Be truly customer-centric

Microinsurance requires a shift in thinking to be more customer-centric: to empathise with the main challenges and needs of low-income customers and to develop holistic solutions, rather than products, built from a deep understanding of these needs.

Respond to a need

Respond to a need

The health startup WellaHealth in Nigeria learnt from their customers that they struggle to cope with malaria. In response, the company bundled a malaria test kit with insurance to cover the treatment.

Design a first-line support

Design a first-line support

For retail clients, insurance is conceived as an indemnity cover. The insurance covers the expenses of hospital treatment or house repairs after a fire up to a certain limit.

For microinsurance clients, insurance should be conceived primarily as an assistance. The premium you can charge to low-income clients is limited and will not suffice to cover an entire loss of crop or health treatment.

We encourage insurers to build holistic solutions, whereby insurance complements other services that can help clients to cope with a setback. These solutions should be affordable, which is not the same as cheap. Affordable means that you collect premiums when people can afford it — for instance, monthly instead of annually.

Bima has expanded its health offering from hospital cash insurance that provides a daily allowance for each day of hospitalisation, to related services, such as teleconsultations, pharmacy discounts and doctor appointments. By doing so, Bima wants to increase the usage of its services and become the go-to-solution when customers face health issues.

Be there in times of need

Be there in times of need

One of the most obvious differentiators between retail and microinsurance is that low-income families have scarce financial means. If the insurer is not around when the hospital bill or funeral parlour needs to be paid, low-income families must tap into their scarce savings, take out an emergency loan or sell a cow or other assets. The value of microinsurance is reduced significantly in such a scenario.

It is, therefore, crucial to be there when your customers really need you. That requires a radically different approach to how claims are reported and processed, as claims need to be paid in a matter of hours or days, not months after an incident occurs.

Equally important is to design microinsurance solutions for high-claims frequency. If people never make a claim, they will never experience the value of insurance. It is, therefore, important to design insurance that people can experience. It is preferable to have 1,000 people making a $100 claim than 100 people making a $1,000 claim.

The staff of Pioneer Insurance and their partner, the microfinance institution Card MRI, visit affected homes the day after the passage of a typhoon in the Philippines, to immediately pay out claims so that the families can buy material to rebuild their houses.

Build true partnerships

Gaining a deep understanding of customer needs, being there in times of need, and building trusted relationships becomes easier if you team up with organisations that have already established trust and communication channels with the communities you want to serve. In microinsurance, it takes two to tango.

Upgrade the core business

Upgrade the core business

Insurance commissions seldom suffice as a foundation for a thriving partnership. The potential revenue is not attractive enough for the legwork and knowledge-sharing required of a distribution partner.

Presenting a catalogue of insurance products to a partner will only suceed in making intermediaries compare your offering on price with others.

Instead, we recommend insurers to remain consistent with their customer-centric approach to microinsurance and build a deep understanding of the problems and risks faced by their potential partner. They should work on insurance solutions that respond to a need of both the customer and distribution partner. Offering better loan repayment rates or developing more loyal customers is a far more attractive value proposition than a side-hustle from commission income.

Hollard Insurance in South-Africa partners with funeral parlours. The parlours sell insurance policies with their funeral services as a benefit. It guarantees the funeral homes customer loyalty.

Co-own the programme

Co-own the programme

We encourage insurers to go beyond revenue sharing, to truly co-own the programme. This includes everything from co-designing the insurance solutions and integrating education to marketing and sales and shared ownership of claims settlements. Partnerships that thrive also have a shared financial responsibility: they don’t only share revenue in the form of commission but in profit and loss too.

Having skin in the game alters the game altogether. If a distribution partner shares profit and loss, it is not incentivised to just sell more insurance but also take moral hazard and adverse selection into account.

In Pioneer Insurance’s joint-venture with the microfinance bank Card MRI the strong partnership signals that both parties are in it together for the long run. Their collaboration does not break if another insurer offers higher commissions. It also makes Pioneer responsible for satisfying the needs of Card MRI and its members.

Compete on value not price

Compete on value not price

Paying claims quickly is not just ethically right and the duty of a microinsurer – it can be better for the business. Think of claims not as a cost but as an investment in the future of the business and an opportunity to demonstrate the value of insurance.

A smooth and swift claims process can be an engine of growth and one of your best “advertisements” as word-of-mouth travels fast in connected communities.

In fact, many people who have not experienced insurance before will trust these word-of-mouth recommendations from community members far more than any company ad. And this in turn will build your reputation as a trusted insurer to attract new partners.

After typhoon Haiyan in 2014, Pioneer had to pay out many claims. In the subsequent year, premium income increased from one million US dollars to seven million.

Organise for innovation

Corporate innovation is the best way for an insurer to prepare and grow its microinsurance business. It requires a long-term mindset, experimentation with unconventional distribution approaches and the right people who are passionate to drive the development.

Act on purpose

Act on purpose

Like any innovation, microinsurance takes time to nurture and grow. This inconvenient truth is generally not what insurance companies with demanding stakeholders want to hear.

There is no mistaking that microinsurance businesses are complex endeavours requiring collaboration between many moving parts. Many microinsurance failures started out on the right track but were not given enough time because they were built on unrealistic short-term promises of outreach and revenue.

Insurers who are successful in microinsurance have allowed their programmes to grow, with a long-term vision that looks beyond revenue and profit. They want to be the insurer of choice for the entire country or want to grow with low-income customers as they graduate out of poverty. They want to do well by doing good.

AXA’s Emerging Consumer business is without doubt a very small contributor to its 28,349 million Euro total revenue in 2021. Its 22 million emerging consumers, however, represent an ever-increasing proportion of its 105 million clients, with promising long-term growth potential.

Assign a champion

Assign a champion

Developing and growing microinsurance activities is quite a dramatic shift from business-as-usual. To be successful in microinsurance, you need a champion on board: an entrepreneur who lives, works and breathes to make the endeavour a success and who’s not afraid to experiment, fail, learn and try again.

Of course, to succeed, he or she also needs the backing of C-level sponsors who can provide air cover if others become impatient, bring important stakeholders on board and remove the types of obstacles, procedures and rules that make sense for an established business but not for more experimental and innovative endeavours.

Learn to unlearn

Learn to unlearn

By now it should be clear that microinsurance is a radical departure from the traditional approach to insurance. It is an unknown product for an unknown customer segment that requires entirely new “recipes” to make it work. Classic insurance-product knowledge can be a burden rather than an asset. It’s little use trying to retrofit microinsurance into traditional processes and models.

To thrive in microinsurance, then, insurance solutions need to be developed from a deep understanding of customer needs together with likeminded distribution partners. Innovation tools and techniques like Design Thinking and the Lean Startup methodology provide important guidelines to start and grow the customer-centric approach to microinsurance.

We worked with Access to Finance Rwanda to kickstart the microinsurance activities of three insurers, together with other supporting partners. We started with a two-week Design Sprint to identify customer needs, from which microinsurance solutions were developed that reached 120,000 low-income earners in just one year.

Creating your recipe for success

The nine ingredients described here might sound like common sense. To be successful, you need all of them to work together and reinforce each other.

This is a huge leap for many insurers and it requires strong conviction, strong commitments, strong leadership, and strong partnerships.

And the devil is in the details, as it is often the case.

How long is long term? What should be the guiding metrics to evaluate a project when profitability is not within reach? How do you find true distribution partners? And how do you reorganise your organisation around partners and customers instead of products?

These are all challenging questions to answer. That’s why the first two weeks of the Microinsurance Master accelerator are spent immersed in the business of a microinsurance champion — to experience first-hand how this different approach to (micro)insurance works. During the accelerator, you are also partnered with an experienced senior microinsurer to mentor you in implementing your takeaways back home so that you can better serve the in-need communities you work.

The Microinsurance Master accelerator programme helps insurers across the globe to take the necessary leap. Over the past four accelerators , 95 champions from 70 organizations in 35 countries have taken the insights learnt out to their communities to make a real difference.

The 2024 edition of the Microinsurance Master accelerator programme is fully booked. The 2025 programme is open for 20 CEOs and key decision-makers who are serious about making a difference in microinsurance.

Apply now if you would like to be one of them.